- April 15, 2021

- Posted by: detaxify

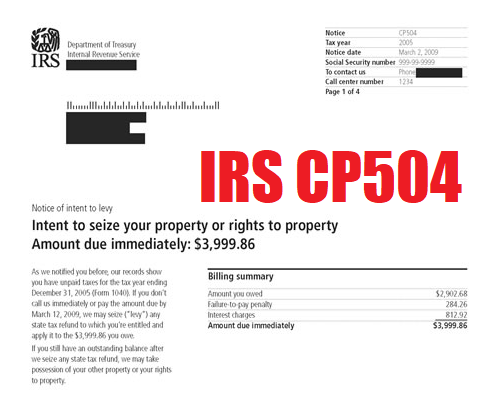

The other day we had a client who came to us with THIRTY ONE (yes, count ’em), 31 LETTERS all sent via Certified Mail from the IRS. All of these notices had the infamous CP504 coding on the upper-right of the letter.

People often get worried about this notice; we previously wrote about this CP504 notice on our article here.

We try to remind our clients and taxpayers – this is not the notice to worry about; but nonetheless, the IRS method of sending this by Certified Mail (which is somewhat unusual lately as of 2021) does not really help give anyone assurances or piece of mind about potential collection actions.

In MANY cases (and note, this can potentially not apply to your specific situation), the CP504 Notice is the final notice before the IRS is allowed to levy your account; it is the second to last notice.

The law requires the IRS to give proper notice before they can levy your bank account.

According to Internal Revenue Code Section 6330, the IRS is required to notify you in writing before levying. The notice must include information telling you about your right to appeal the threatened collection action within 30 days.

The CP504 usually does not have the required appeal rights information that the IRS is required to provide before levying an account (note, they may still be able to file a lien against you at this point).

This second to last letter “Notice of Intent to Levy” does not contain this notice of your right to appeal.

Here is a link to the IRS website that explains what notice the IRS must give before levying.

The good news is that normally the IRS sends you five letters (five for individuals and four for businesses) before actually seizing your assets.

These notices are about five weeks apart so that you have at least four or five months to prepare for the final notice.

Here are the collection letters the IRS mails to individuals:

- CP14 (Notice of unpaid taxes)

- CP501 (Reminder of unpaid taxes)

- CP503 (Second reminder of unpaid taxes)

- CP504 (Notice of Intent to Levy) May seize state tax refund by stated deadline.

- Letter 1058 or LT 11 and other letters (Final Notice of Intent to Levy and Notice of Rights to Appeal).

The first three notices are sent by regular mail and the final two by certified mail.

Keeping your Options Open

It’s recommended to take actions to resolve the matter before it gets to the Final Notice of Intent to Levy. If it gets to this stage, it’s highly recommended to consult with a tax professional – you have only 30 days to file a Collections Due Process hearing (“CDP hearing”) (instead of a “equivalency hearing”) which could give you the right to petition the U.S. Tax Court if you disagree with the CDP hearing results.