- November 29, 2018

- Posted by: detaxify

The IRS carries several serious powers at its disposal. One of its tools of trade, the levy, can be daunting to come up against.

A levy, as some of you may already know, is when the IRS secures some of your assets in an attempt to recoup the tax debt that they claim you have. The IRS has many freedoms in how it can levy you, but what the IRS cannot do is Levy a without notice. This is part of their governing code, the Internal Revenue Code Section 6330. Section 6330 states that the IRS must notify you in writing before levying, and inform you of your rights to file an appeal within 30 days in response. If an appeal is filed, they IRS cannot levy you until the appeal is resolved.

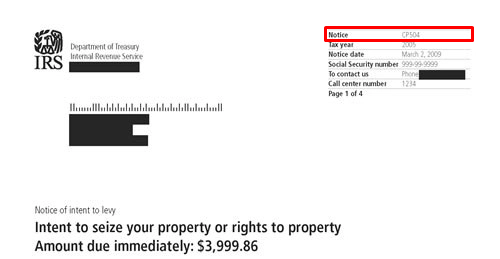

This written notice is called a Notice of Intent to Levy, and they come in two nearly indistinguishable forms, but that are fairly different. So what is the difference, and how can you determine which notice means what?

The difference in the notices is in the content of the letter. As IRC section 6330 states, the IRS cannot levy without informing you of your appeal rights. The first Notice of Intent the Levy the IRS can send to you will state, “This is a notice of intent to seize (“levy”) your state tax refund or other property. As we notified you before, our records show you have unpaid taxes for the tax year ending December 31, 20XX. If you don’t call us immediately or pay the amount due, we may seize your property or rights to property (including any state tax refunds) and apply it to the amount you owe.” As you can see this letter does not inform you of your rights to appeal. This letter is also identifiable by the identifier in the upper right hand corner of the letter. These notices have the identifier of CP504. The IRS will often send these out ahead of the “real” notices. If you receive one of these, it is a good idea to seek out some help, as you are in the IRS’s collection system.

The other notice, that comes with the identifier of LT11 (or sometimes L1058) is most easily identified by the inclusion of a notice that you can file an appeal, and even the relevant forms needed to do so.

Regardless of which notice you receive, it is highly advised to seek out professional help. If you are unsure if you received the letters out of order, you can contact the IRS to confirm. Your account transcript with the IRS will state whether or not a final notice has been disbursed, and when.