- August 4, 2023

- Posted by: detaxify

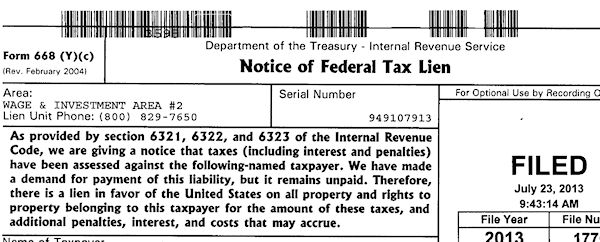

If you’ve recently received notice that the IRS has filed a lien against you, it’s natural to feel stressed and anxious about your financial situation. An IRS lien can be a challenging situation to navigate, but it’s essential to stay informed and take proactive steps to resolve the issue. This comprehensive guide will walk you through what an IRS lien is, its implications, and the necessary steps to address the situation and protect your financial well-being.

Understanding an IRS Filed Lien

An IRS lien is a legal claim the Internal Revenue Service places on your property and assets as a means to secure tax debt repayment. It is a powerful tool used by the IRS to ensure they have the first claim to your assets, making it challenging for you to sell or transfer properties until the tax debt is settled. While IRS liens used to impact credit scores, they no longer have a direct effect on your credit score.

Reasons for an IRS Lien

The IRS typically files a lien against a taxpayer when they owe a significant amount of unpaid taxes, and they have failed to respond to previous notices or make arrangements to settle their tax debt. If you have received a lien notice, it means the IRS has thoroughly assessed your situation and believes the lien is necessary to protect their interests.

Implications of an IRS Lien

The consequences of an IRS lien can still be significant and far-reaching. They may include:

- Difficulty Selling Property: With an IRS lien attached to your assets, it becomes challenging to sell or transfer ownership of properties until the tax debt is fully paid off.

- Difficulty Obtaining Loans: Although IRS liens don’t directly impact your credit score, lenders may still consider an IRS lien as a red flag, making it challenging to secure loans for homes, cars, or business ventures.

- Bankruptcy Complications: An IRS lien can complicate bankruptcy proceedings, potentially limiting your options for debt relief.

Steps to Resolve an IRS Lien

- Assess Your Situation: Review the lien notice carefully to ensure the accuracy of the information and understand the specifics of your tax debt.

- Consult a Tax Professional: Consider seeking assistance from a tax professional, such as a certified public accountant (CPA) or a tax attorney, to guide you through the process, negotiate with the IRS on your behalf, and ensure your rights are protected.

- Negotiate a Payment Plan: The IRS offers various payment plans to taxpayers who are unable to pay their tax debt in full. Depending on your financial situation, you may qualify for an installment agreement or an offer in compromise.

- Request a Withdrawal or Discharge: In some cases, you may be eligible to have the lien withdrawn or discharged. This can be achieved through payment, bond, or other arrangements. A tax professional can assist you in determining if you qualify for this option.

- Stay Compliant: Once you’ve resolved your tax debt, it’s crucial to stay compliant with all future tax obligations to avoid any further issues with the IRS.

Conclusion

Dealing with an IRS filed lien can be daunting, but it’s essential to address the situation promptly and proactively. Consult a tax professional, explore your payment options, and take the necessary steps to resolve the lien. By staying informed and compliant, you can overcome this financial challenge and safeguard your financial future. Remember, there is support available to guide you through this process and ensure you make informed decisions regarding your tax debt.