- April 5, 2024

- Posted by: detaxify

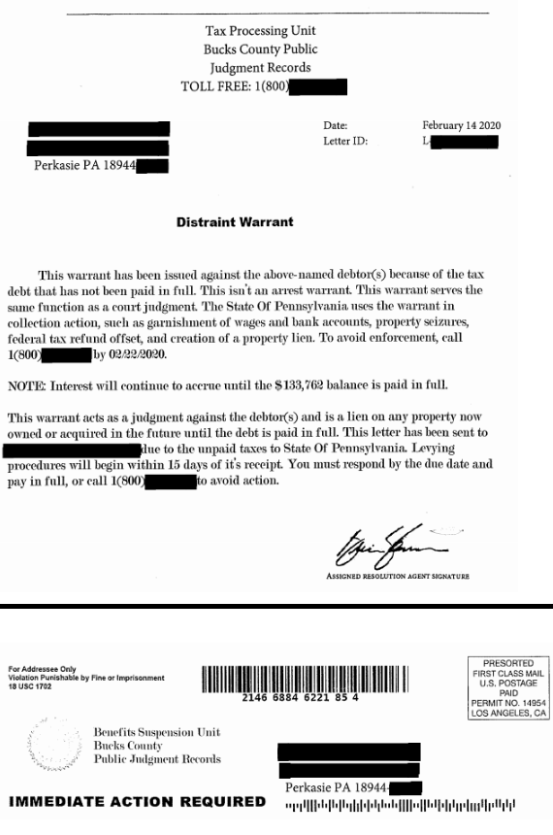

Good news – this letter is generally a scam. Some people have reached out to us after having received scary looking letters with a bold caption on top labeled “distraint warrant”. It also refers to the fact that a “warrant” was issued against them. If you received one of these letters; it’s usually because you have an existing IRS tax lien or state tax lien equivalent which causes your information to be recorded at a local county recorder. This becomes a matter of public record and some companies ‘scrape’ this information across the country to then use for marketing purposes. The “distraint warrants” which is not an IRS distraint warrant (no such thing exists) are sent out to you to scare you into calling these companies for tax relief services.

The State of Texas, for one, has now started potentially cracking down on these. See a notice from the Texas Comptroller’s Office here.

An actual notice from the IRS usually has a certain format and the IRS logo on the top left, such as a for example, a collections notice, called a CP504 notice. However, these “distraint warrants” are usually not sent from any actual agency. They are sent from a private company scaring consumers into calling them.

Why do they have my information?

How did they get your information? Usually, if you have a distraint warrant, it is because you may have a Notice of Federal of Tax Lien filed against you from the IRS. In some cases, you may have had a state tax notice filed against you. Some states, like New York State, actually also call their tax liens as a tax warrant as well. However, to our knowledge, there is no official notice called a “distraint warrant”.

A Federal Tax Lien is public record – it will usually be recorded in your local county recorder’s office based on the address which the IRS has on file for you (last known address). These public records are sometimes compiled by companies and used for marketing purposes. In this case, the “distraint warrant” is sent to scare you into calling a company to sell you services.

Should I worry about a distraint warrant?

The actual “distraint warrant” itself – no; it is usually not a real notice. However, if you have one filed, it means you have an underlying tax issue. If you have not already figured out your tax issue, know that usually a lien comes as a step before the IRS takes additional enforcement action. Unless you already took a step which you knew a lien would be filed (such as obtaining a “Currently Not Collectible” status), we recommend calling a tax professional to see exactly what your options are and what you need to do to resolve this.

Has anything changed about distraint warrants in 2023? Our research generally shows that these notices are still indicative of a scam to try to scare consumers to try to fix their tax issue. However, if you were issued a distraint warrant, you may likely have an underlying tax problem for which public records were pulled – you have a lot of rights in resolving your tax issues; these rights are not explained on unofficial distraint warrants (which are, as explained above, just marketing tools used by private companies who use this as a scare tactic for you to sign up).

What else can I do?

We can potentially help you further investigate and provide a free consultation. Feel free to contact us through our form here and we will contact you to assess your situation and discuss some options you may have with you.