- September 21, 2022

- Posted by: detaxify

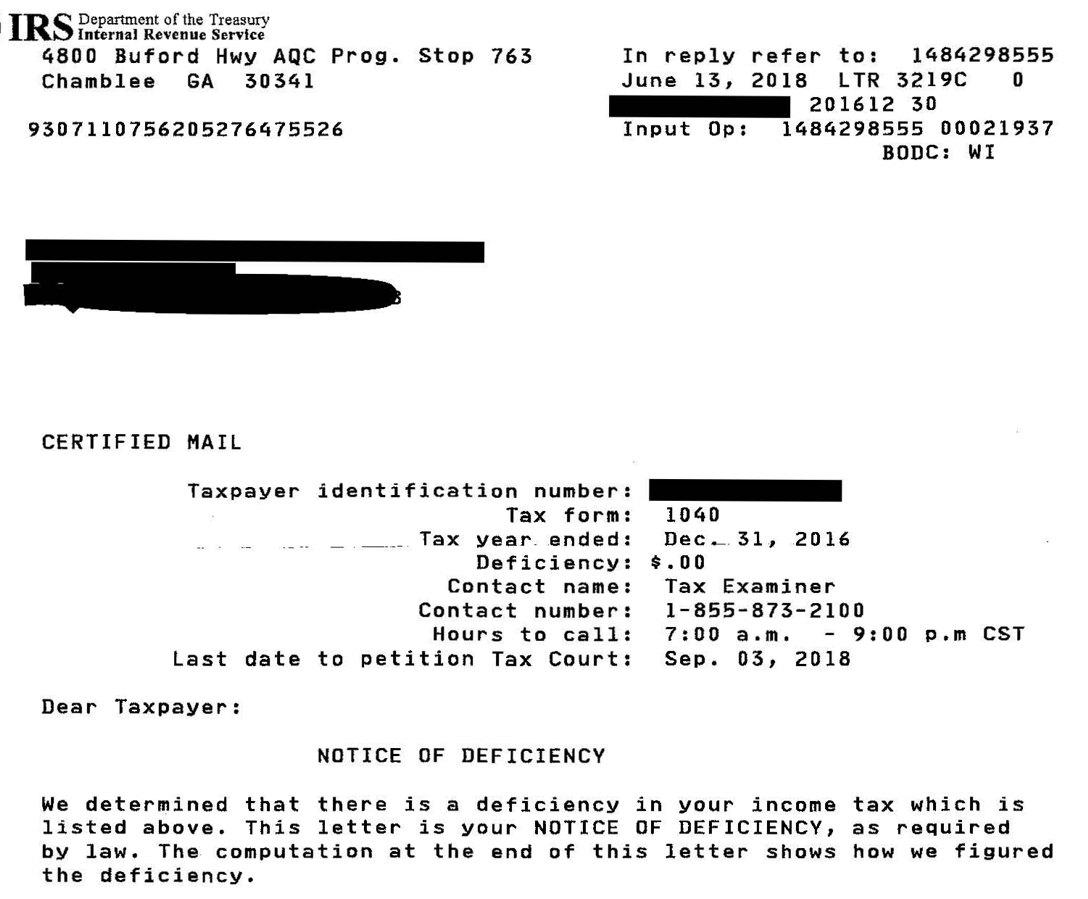

This article is a work in progress to help Taxpayers determine what to do with a Notice of Deficiency.

What is a Notice of Deficiency?

A Notice of Deficiency (commonly abbreviated as NoD by professionals) is the IRS giving you final notice of what their determination of tax is. Usually, this is the final chance in having leverage to be able to resolve your matter. It is the IRS in simple terms saying: we’re done – this is your tax, and it’s final.

You have 90 days from the time a Notice of Deficiency is sent to you (it does not matter if it is actually received by you, only that it is sent from the IRS – we will write more on this later) to file a petition to the United States Tax Court. We are simplifying this somewhat but filing a Petition to the United States Tax Court allows you to have your entire tax matter heard before a judge. If you did not appeal your tax determination, you get a chance to have your matter heard before the IRS Office of Appeals (which is a highly recommended pathway because they know you are about to go to court).

The IRS Office of Appeals will at this stage try to settle the case with you assuming you have a strong case on your side. If you believe you do not have a strong or perfect case, it is advisable to consult with a tax professional. In some situations, if you are completely wrong on the tax law, the IRS will not settle and will take your case to trial in order to defend their position and the standing of the tax law being administered properly.

The IRS Sent Me a Notice of Deficiency – What Do I Do Exactly?

If you do not agree with the tax adjustments proposed on the Notice of Deficiency, it is strongly recommended that you consult with a tax professional who is admitted to practice before the United States Tax Court. Detaxify has professionals available who are admitted to the United States Tax Court. If you prefer to handle the matter yourself, familiarize yourself with the U.S. Tax Court petitioner’s guide and make sure you do anything possible to file your petition before the 90-day deadline.

The 90-day deadline is ABSOLUTE (meaning there are no exceptions for being late – although this is currently being litigated). Do not miss this deadline. If the dollar-amount on the Notice of Deficiency is large ($10,000 or more); we strongly advise you to consult a professional admitted to the United States Tax Court.